Products & Services

MCM’s model’s, systems, and consulting methods of pipeline risk management allow mortgage bankers to grow revenue, decrease earning volatility, increase profitability, and efficiently manage their risks. We provide the tools and consulting needed to get the job done right!

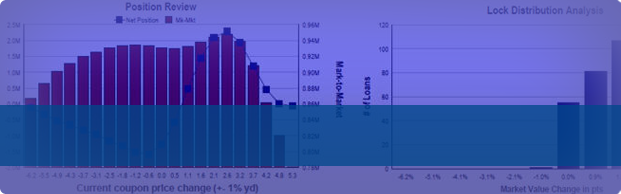

MCM uses both its proprietary and industry standard financial models and real-time market data to provide an accurate picture of each client’s pipeline from commitments to closed loans. The reporting from the MCM system allows clients to view the key elements of their pipeline under different scenarios in real time. Clients can also take advantage of the invaluable experience and independent market perspective of MCM’s Senior Advisors to help make informed decisions.

After reviewing the information contained in an MCM Risk Position report, clients are usually able to execute their own hedging strategies. However, for those that need additional coaching and training, MCM will execute hedge recommendations; provide best execution analysis and polling services. This involves trading TBA mortgage backed securities, options on TBA MBS, and Treasury and Eurodollar futures and options through accounts established by the client with investors authorized by the client’s board of directors.

In addition to day-to-day pipeline/risk management, MCM helps mortgage companies:

- Analyze current operations through extensive reporting such as timeline analysis

- Adopt the “best practices” observed throughout the industry

- Establish key relationships with secondary market participants

- Train or coach key employees

- Develop growth and contingency strategies

- Custom modeling and reporting as needed

- Servicing Premium Valuation on a tailored OAS basis

- Integration of data and reporting with front-end and back-end systems

- Fallout modeling, reporting and grading by branch or loan officer

- Compliance with regulatory requirements

- Price and Hedge Forward Builder Commitments

- Compare pipeline stats like new locks and margins to peer review online

- Organize historical reporting and data management